Day trading has become a popular strategy in the market for financial instruments. It allows traders to take advantage of short-term changes in price. For those who utilize Ninjatrader having the right tools can make a significant difference in trading success. This article provides a comprehensive guide to Ninjatrader’s day trading indicators and trade signals, along with strategies and techniques. This is appropriate for both new and experienced traders.

Understanding Ninjatrader Day Trading Indicators

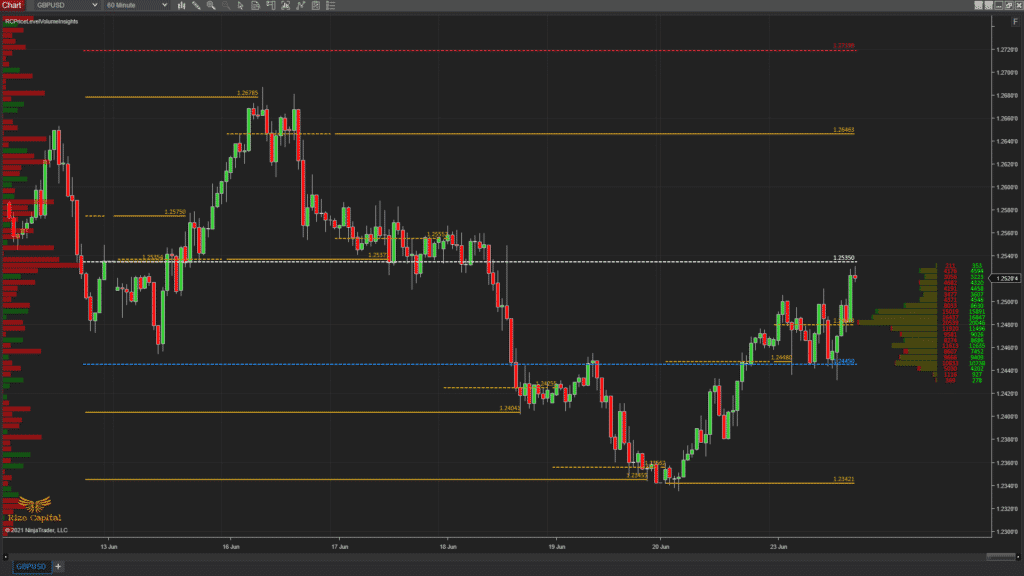

Ninjatrader day trading indicators are vital tools that help traders analyze market data and make informed decisions. These indicators are based on various data sources, like volume, price and time. Indicators like Bollinger Bands (Bollinger Averages) and the relative Strength Index (RSI), are very popular. These indicators help traders discern trends, assess market volatility and find potential levels for entry and exit.

To prevent information overload in the market, it is vital for new traders to start with a couple of reliable indicators. Moving averages are an ideal starting point as they smooth price data in time, highlighting trends. As traders get more experience as they gain experience, they’ll be able to incorporate more indicators into their analysis.

Ninjatrader Day Trading Signals What is their role?

Ninjatrader generates day trading signals according to the criteria that the trader has defined. These signals alert the trader to possible buying or selling opportunities on the market. The signals are based on an individual indicator, or any combination of them. This allows for a thorough analysis.

Ninjatrader can create a trading signal that is automated. The automation will eliminate emotional bias and make sure that trades are carried out based on objective criteria. The traders are able to test their trading signals using the historical data to assess their efficacy before they use them for live trading.

Crafting Effective Ninjatrader Day Trading Strategies

A winning trading strategy is crucial to earn consistently profitable gains. Ninjatrader day trading strategies can range from simple to complex, depending on the traders’ experience and the risk tolerance. The most basic strategies may include moving averages for trend detection as well as a stop loss order to control risks. Advanced strategies may contain multiple indicators, intricate entry and exit rules and automated execution of trades.

It’s crucial to take into account the market conditions and the objectives of the trader in determining strategies for day trading. Strategies must be able to adapt to changing market environments since what works in a market that is moving may not be effective in a range-bound market. Reviewing and changing strategies regularly will help them remain effective as time passes.

Building Robust Ninjatrader Day Trading Systems

Ninjatrader is a trading platform that combines signals and indicators into a unified framework. These systems could be fully automated, meaning that the program takes care of all aspects as well as being completely manual where traders execute trades based on signals.

Automated trading systems offer several advantages, including improved efficiency, a reduction in emotional trading, and the ability to back-test strategies rigorously. However, there are a number of risks inherent to them, such as malfunctioning systems and unpredictable conditions in the markets. It’s vital for traders to maintain their systems and be prepared to intervene in the event of a need.

Day Trading: Common challenges and solutions

Although day trading is an investment that can be lucrative however, it also comes with some difficulties. Beginning traders are likely to face issues because of unrealistic expectations regarding trading, reliance of random indicators and emotions in decision-making. To overcome these challenges it is essential to have a clear understanding of the market, and to have realistic expectations.

Success in day trading is dependent on risk management. It is essential that traders only invest funds in risk capital that they can lose without risking financial security. Position sizing, stop-loss order and other risk management techniques can protect your investments and assist in reducing risks.

The reason you require high-end trading tools

Having access to high-quality trading tools is crucial for your success in day trading. IndicatorSmart is one example. It offers high-end Ninjatrader Day trading indicators, systems and signals to give traders the most efficient resources. These tools are able to enhance the analysis of markets, aid in making better decisions, and ultimately lead to better outcomes in trading.

The final sentence of the article is:

Ninjatrader is a robust platform that has numerous features and tools to improve the performance of trading. Ninjatrader indicators as well as strategies, signals and indicators can be used to build a well-rounded trading approach. Success in day trading requires continuous learning, adaptation, and the making use of resources. If you have the right attitude and the right tools traders can navigate the challenges and obstacles of day trading and achieve their financial goals.