Expanding an online business into new markets is an arduous task, especially when you have to deal with the complexities of VAT registrations tax filings, VAT registrations and producer responsibility. But, with the right tools and assistance, this process can become considerably more manageable. Staxxer is a comprehensive solution that acts as a one-stop store for all of your VAT and EPR needs. This makes sure that you have seamless and efficient operation in Europe for ecommerce sellers.

The challenges of VAT Compliance

The compliance with the Value Added tax (VAT) is among the most crucial aspects when running an online business in Europe. Each country has their own VAT regulations and to stay compliant, you need to pay attention. E-commerce companies must register with VAT authorities in every country where they sell and submit regular returns of VAT, and make sure that they are able to accurately calculation of the VAT due. This is a lengthy process and is prone to error, and takes valuable resources from core operations.

Staxxer is your all-in-one source for VAT compliance

Staxxer simplifies VAT compliance through providing an all-in-one solution for VAT registration and VAT filing. Through automation of these processes, Staxxer lets online retailers concentrate on growth and expansion without the burden of administrative tasks. Here’s how Staxxer makes VAT compliance effortless:

Automated VAT registration: In order to expand into a different country you have to sign up with the VAT authorities in that country. Staxxer handles the entire process of registration. This helps ensure the compliance with local laws, and also eliminates the need to have companies to navigate the complicated bureaucratic processes.

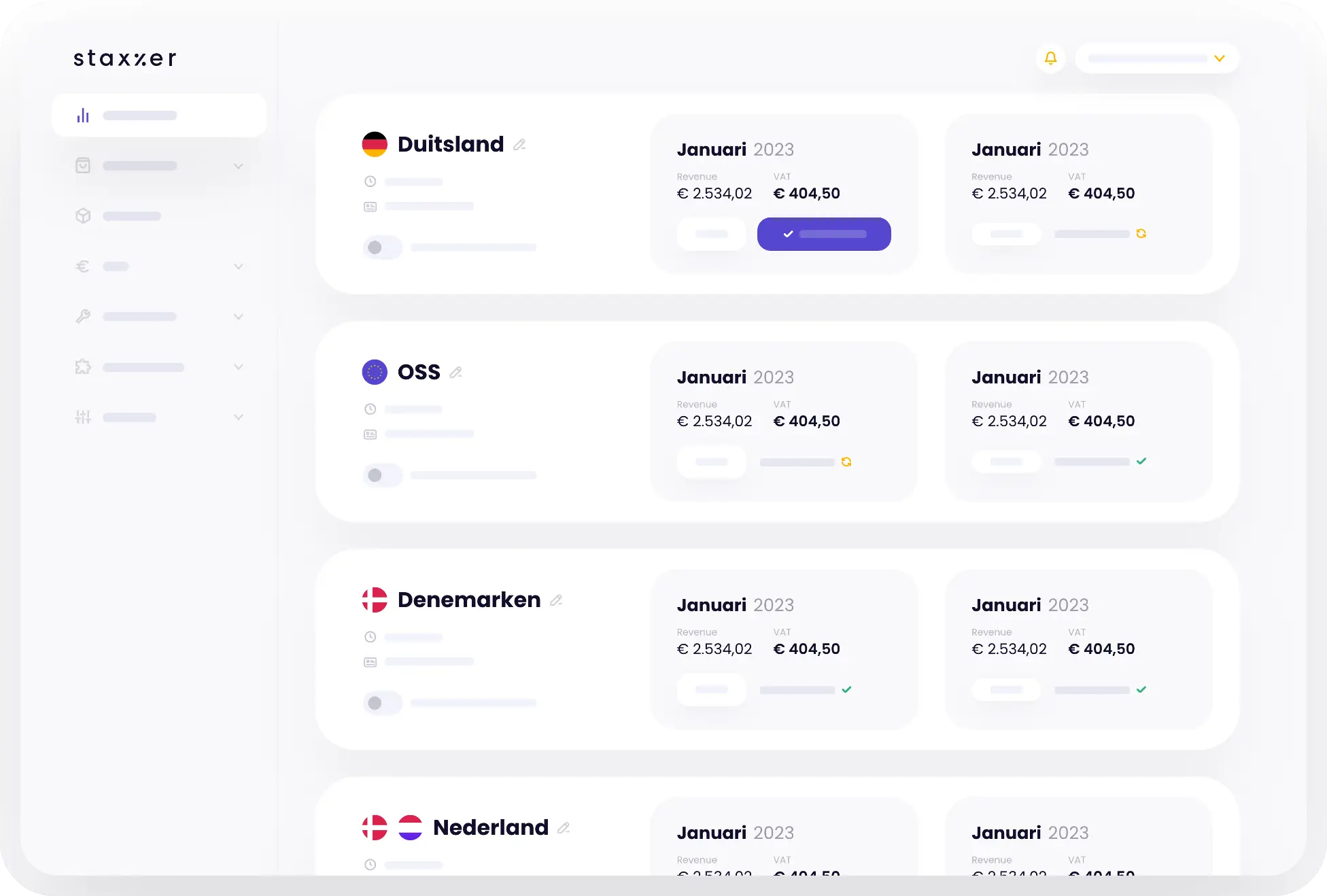

Effective VAT Filing Taxes are mandatory for all companies in Europe. Staxxer’s software makes VAT filings easier making sure that they are timely and exact submissions. The platform connects to all sales channels and consolidates information to calculate VAT for each country to the last penny.

Staxxer offers a comprehensive VAT management solution, starting with the calculation of VAT and ending with processing declarations. This comprehensive management solution allows companies to remain compliant while not needing to devote substantial resources and time to VAT-related tasks.

Role extended producer accountability

EPR is a policy which holds the manufacturer accountable for every aspect of a product’s lifecycle, including recycling and disposal. For online businesses that means adhering to regulations related to packaging and electronic waste and other product-specific waste streams.

Staxxer’s EPR Solutions

Staxxer has expertise in this particular area, too. Staxxer can assist businesses in meeting their EPR obligations.

Automated EPR Compliance Staxxer’s platform incorporates EPR compliance with its services by automating the reporting process and management of waste requirements. It makes sure that businesses are in compliance with environmental regulations without adding additional administrative burden.

EPR demands a comprehensive report of the types and amounts of waste generated. Staxxer’s software simplifies this process by combining data and generating exact reports, which ensures compliance with local and international regulations.

Sustainable Business Practices. Companies can increase their sustainability through a better management of EPR requirements efficiently. Staxxer’s solutions help businesses reduce their environmental footprint while also promoting sustainable production and disposal practices.

Why Entrepreneurs Choose Staxxer

Entrepreneurs and companies that deal with e-commerce select Staxxer for its complete automated solutions that simplify the compliance of EPR and VAT. Here are some key benefits.

Automating VAT filings and EPR Compliance allows businesses to focus more to expand and grow. Staxxer solutions make it unnecessary to perform manual data entry and administration tasks.

Accurate Calculations: The Staxxer platform makes exact calculations of the tax owed in each country, thus reducing the risk of errors and penalties. It is crucial to ensure the compliance of tax laws and avoid costly mistakes.

Ease of Use Its easy-to-use interface and seamless integration with various sales channels makes it simple for firms to manage their VAT and EPR obligations. Staxxer’s intuitive design streamlines complicated processes and allows compliance to be simple.

Staxxer will allow businesses to operate without fear, knowing that they’re in compliance to all applicable regulations. Peace of Mind is crucial for entrepreneurs looking to expand operations without worrying about the regulatory aspects.

The article’s conclusion is:

Staxxer serves as a one stop shop for e-commerce businesses seeking to simplify VAT and EPR compliance. Staxxer streamlines VAT registration, filings and EPR filing obligations. It allows companies to focus on expansion and growth. Staxxer’s comprehensive platform ensures accuracy in calculation, prompt submission, and a sustainable process that makes it the ideal option for entrepreneurs who wish to expand without difficulty. Explore Staxxer’s offerings and discover how easy it is to comply.